Ad Blocker Detected

Our website is made possible by displaying online advertisements to our visitors. Please consider supporting us by disabling your ad blocker.

Insurance provides a wide range of benefits for individuals and societies as a whole. It helps people and businesses recover from unexpected events that could otherwise derail their financial plans.

An insurance company’s profit comes from pooling the money of many insured parties into accounts reserved for later payments of claims (called reserves). The amount charged by an insurer for coverage is called a premium.

Definition

Insurance is a legal contract between the insurer and insured, whereby the former pays a regular amount called premiums to the latter in exchange for financial compensation in the event of unfortunate events or circumstances. This compensation is subject to certain conditions or clauses called policy terms.

The objective of insurance is to transfer risk from those who cannot afford to bear it and onto those who can. This can help individuals and societies mitigate the effects of catastrophes on their finances and quality of life.

The key elements of insurance are calculable loss (probability) and cost. Calculating probability is an empirical exercise; calculating costs requires gathering historical data and bringing it to present value using various methods, such as reserving and rate-making.

Types

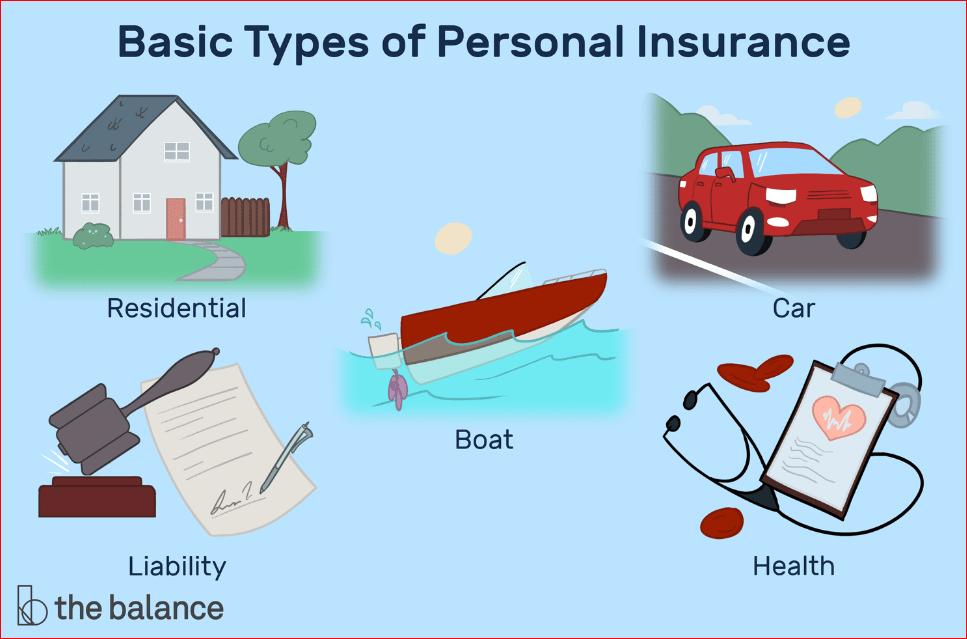

There are many types of insurance policies, but the most common include auto, home, and life insurance. There are also specialized forms of insurance such as kidnap and ransom (K&R) or wedding liability and cancellation insurance.

Insurance works by pooling the risk and premiums of many insured individuals. Then, when one person makes a claim, the insurer pays from this pooled fund. This helps to mitigate damage and loss for everyone involved and stimulates economic growth by mobilizing domestic savings into productive channels.

Insurance policy limits can vary by type and include per-occurrence, per-person, and aggregate limits. In addition, there are special limits such as those for expensive jewelry, antiques, and cars under homeowners’ insurance; and POS (Point of Service) or exclusive provider organization plans under health insurance.

Coverage

Insurance coverage is available for a variety of exposures. Some examples include property, auto, business interruption and liability.

Insurance can be provided either directly or indirectly. Direct writing companies sell policies through salaried representatives or exclusive agents. Reinsurance is an indirect way of providing insurance through a contract with another company, called a ceding company.

Rates are calculated to reflect the relative frequency and severity of risks underwritten. Initial rate-making involves collecting historical loss data, bringing it to present value and comparing it with the premium collected. More sophisticated methods are used when different risk characteristics are involved, such as multivariate analysis. Insurance can also be purchased to protect against the nonpayment of debt associated with a credit transaction. This is commonly called credit default insurance. contact

Premiums

Whether it’s for a car, home or life insurance, you pay an insurance premium to help cover your losses. The amount of your premium depends on the dollar value of your coverage, and a variety of other factors. These include your age, location and the likelihood of making a claim.

Some factors are used for specific policies, such as a credit score, driving history or occupation, while others are universal, like the cost of a car in a particular area. In addition, insurance companies often determine their target client and create programs or discounts to attract them. They also rely on actuaries to make sure they are charging enough for the risk they’re taking on. This helps keep rates consistent and competitive across the industry.

Claims

An insurance claim is a request for payment from the insurer after an incident that’s covered by the policy. The money from a successful claim helps to replace or repair damaged property, pay medical bills for injuries, and other expenses related to an accident or illness.

Insurance fraud is a deliberate deception perpetrated by individuals and organizations for financial gain. It can occur at various points in the insurance process and involves a variety of tactics such as padding claims, misrepresenting facts on an application, and staging accidents.

Other types of insurance fraud include premium diversion, fee churning, and asset misappropriation. Understanding your insurance policy can help you spot and avoid these forms of fraud. Also, remember that any claim you make may impact your rates for many years. gaming!