Ad Blocker Detected

Our website is made possible by displaying online advertisements to our visitors. Please consider supporting us by disabling your ad blocker.

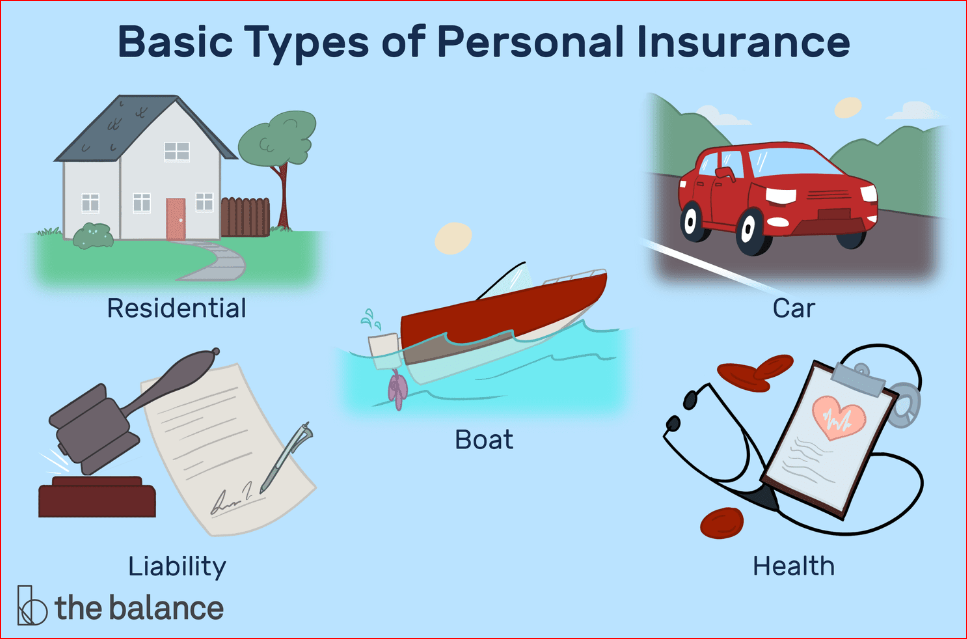

Insurance is a mechanism to protect people against financial loss. It works on the principle of pooling in risk from many people who are likely to suffer the same loss, in exchange for a premium.

This is done through the actuarial science, which uses probability to predict future losses and set rates accordingly. It helps people recover from unforeseen accidents and calamities, by providing them with the monetary means to rebuild their lives.

Life Insurance

A life insurance policy is a financial safety net that protects your family against the risk of your death. It helps them meet expenses like funeral costs, large medical bills and other living expenses when you pass away. It is a contract between you and the insurer, where you pay a premium for a specific duration called the premium payment term or policy term, in return of which you receive a lump sum amount known as the Life Cover, upon completion of the term. Some policies also accumulate cash value, which is the difference between the premium paid and the amount paid out on death. Other features may be available such as a critical illness rider or accelerated death benefit.

ICICI Prudential offers protection plans such as term life and permanent life insurance that help you plan your finances and secure the future of your loved ones.

Auto Insurance

Auto insurance is a type of property and casualty (P&C) insurance that provides financial protection against physical damage to your car and liability arising from traffic collisions or other incidents. In exchange for a premium, an insurer agrees to pay covered expenses up to certain limits. Most states require drivers to carry a minimum level of third-party bodily injury and property damage liability coverage. Some also mandate additional physical damage coverages such as comprehensive and collision, as well as medical payments coverage for policyholders and their passengers.

The cost of an auto insurance policy varies, and depends on the coverage options, deductibles, and discounts you choose, as well as state laws and your personal risk factors such as marital status, driving record, age, gender, and location. A specialized agent can help you select the appropriate auto policy for your situation and budget. They can also provide information about lowering your rates by taking safe-driving courses and other reductions available in your state.

Home Insurance

Homeowners insurance provides financial protection in case your house or belongings are damaged by a covered event. It also pays for medical bills or legal fees if someone is hurt on your property. Homeowners insurance may also pay for a temporary place to stay if your home is uninhabitable after a disaster.

Most homeowners policies include both buildings and contents coverage, but the specific coverages differ by policy. For example, some policies provide replacement cost coverage while others offer actual cash value coverage (the amount your insurer would pay if something was stolen).

Many factors affect the price of home insurance. Your state and ZIP code, for example, have unique risk profiles that influence premiums. Your credit score might also be used to calculate your premium, as people with higher scores file fewer claims. You can reduce your premium by raising your deductible or adding optional coverages. NerdWallet’s experts can help you understand your options and choose the best home insurance for your needs. resources

Health Insurance

Health insurance is a form of collective financing of health care expenses. In a typical arrangement, workers contribute a proportion of their income to a not-for-profit fund that mutualizes the risk of illness and reimburses medical expenses according to a set tariff. Children and spouses of insured people are also covered.

In the United States, health insurance is regulated at both the state and federal levels. Each state has an insurance commissioner and a department of insurance that oversee regulation of the industry; at the federal level, the U.S. Department of Health and Human Services/Centers for Medicare and Medicaid Services oversees regulations relating to the Medicare program, fully-insured group health coverage and individual/family health insurance (including Medigap, which is sold to supplement Medicare coverage), and ERISA regulates employer-sponsored plans.

When purchasing health insurance, it is important to read the policy document carefully and understand its terms and conditions. This will help you make an informed decision about the type and extent of coverage that you want to purchase developers.